1551 Eastlake Avenue East, Suite 200

Seattle, Washington 98102

April 23, 202126, 2024

Dear Adaptive Biotechnologies Corporation Shareholder:

You are cordially invited to the Adaptive Biotechnologies Corporation 2024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Friday, June 11, 2021, at 9:00 a.m., Pacific Time. . The attached proxy is solicited on behalf of the board of directors of Adaptive Biotechnologies Corporation for use at the Annual Meeting to be held on Friday, June 7, 2024, at 9:00 a.m., Pacific Time, or at any adjournment or postponement thereof, for the purposes set forth in the accompanying proxy statement, Notice of Annual Meeting of Shareholders (the “Notice”) and form of proxy. The Annual Meeting will be held entirely via the Internet, broadcast from our corporate headquarters at 15511165 Eastlake Avenue East, Suite 200, Seattle, Washington 98102.98109.

To be admitted to the Annual Meeting, you must register prior to Wednesday, June 9, 2021,5, 2024, at 2:00 p.m., Pacific Time at www.proxydocs.com/ADPT and enter the control number found on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials you previously received. You may attend the meeting, vote your shares and submit questions electronically during the meeting via live webcast by registering at www.proxydocs.com/ADPT. You must also follow subsequent instructions you may receive by electronic mail thereafter. You may vote during the Annual Meeting by following the instructions available on the meeting access email. At the Annual Meeting, you will be asked to elect threetwo Class II directors to our board of directors, to approve, on an advisory basis, the 2020 compensation of our named executive officers, determine the frequency of shareholder advisory votes regarding the2023 compensation of our named executive officers and to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscalthe year ending December 31, 2021.2024. The accompanying Notice describesproxy materials describe these matters.

We have elected to provide access to our proxy materials on the Internet under the Securities and Exchange Commission’s “notice and access” rules. Our proxy materials are available at www.proxydocs.com/ADPT. We are mailing a Notice of Internet Availability of Proxy Materials on or about April 23, 2021,26, 2024, which provides instructions on how to access our proxy materials and our 20202023 Annual Report on the Internet. Please read our proxy materials and our 20202023 Annual Report carefully before submitting your proxy.

It is important that your shares are represented and voted at the Annual Meeting. You may vote on the Internet or by telephone as instructed in the Notice of Internet Availability of Proxy Materials or, if you are receiving a paper copy of the proxy materials, complete, sign and date the enclosed proxy card and return it in the enclosed envelope as soon as possible.

We thank you for your support and participation.

Sincerely,

Chad Robins

Chairman, Co-Founder and Chief Executive Officer

1551 Eastlake Avenue East, Suite 200

Seattle, Washington 98102

NOTICE OF 20212024 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 11, 20217, 2024

To the Shareholders of Adaptive Biotechnologies Corporation:

The attached proxy is solicited on behalf of the board of directors of Adaptive Biotechnologies Corporation for use at the Annual Meeting of Shareholders to be held on June 11, 2021,7, 2024, at 9:00 a.m., Pacific Time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth below and in the accompanying proxy statement. The Annual Meeting will be held entirely via the Internet. Shareholders may participate in the Annual Meeting by registering at the following website: www.proxydocs.com/ADPT. You will need the control number included on your Notice of Internet Availability of Proxy Materials, your proxy card or the instructions that accompanied your proxy materials for the following purposes:

| 1. |

| Proposal 1: To elect |

| 2. |

| Proposal 2: To approve, on a non-binding advisory basis, the compensation of our named executive officers as described in the proxy statement; |

| 3. |

|

|

| Proposal 3: To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for |

| To conduct any other business properly brought before the meeting or any adjournments thereof. |

We know of no other matters to come before the Annual Meeting. Only shareholders of record of our common stock at the close of business on April 14, 202110, 2024 are entitled to notice of and to vote at the Annual Meeting or at any postponements or adjournments thereof. For ten days prior to the meeting, a complete list of the shareholders entitled to vote at the meeting will be available for examination by any shareholder for any purpose germane to the meeting during ordinary business hours at our executive offices located at 15511165 Eastlake Avenue East, Suite 200, Seattle, Washington 98102.

98109.

YOUR VOTE IS IMPORTANT. PLEASE VOTE YOUR SHARES VIA THE INTERNET, THROUGH OUR TOLL-FREE TELEPHONE NUMBER (866-390-5390) OR BY SIGNING, DATING AND PROMPTLY RETURNING YOUR COMPLETED PROXY CARD. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 11, 2021:7, 2024: THIS PROXY STATEMENT, THE NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND THE ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYDOCS.COM/ADPT.

By order of the board of directors,

Stacy Taylor

Senior Vice President, and General Counsel and Corporate Secretary

April 23, 202126, 2024

TABLE OF CONTENTS

Table of Contents

| 17 | |||

| ||||

| 18 | ||||

| 19 | ||||

|

| 21 | ||

| 23 | |||

| 23 | |||

| 23 | |||

| 24 | |||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 32 | |||

| ||||

| 33 | |||

| 34 | |||

| 34 | |||

| 35 | |||

| 36 | |||

| 37 | ||||

| 38 | ||||

| 42 | ||||

| 42 | |||

| 44 | |||

4

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

Your proxy is solicited on behalf of the board of directors of Adaptive Biotechnologies Corporation (“Adaptive,” the “Company,” “we,” “us” or “our”), a Washington corporation, for use at our 20212024 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Friday, June 11, 2021,7, 2024, at 9:00 a.m., Pacific Time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement, as well as any business properly brought before the Annual Meeting. Proxies are solicited to give all shareholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Annual Meeting will be held entirely via the Internet. To be admitted to and participate in the Annual Meeting, you must register prior to Wednesday, June 9, 2021,5, 2024, 2:00 p.m., Pacific Time at www.proxydocs.com/ADPT and enter the control number found on your proxy card, voting instruction form or Notice of Internet Availability of Proxy Materials you previously received. Upon completing your registration, you will receive further instructions via email one hour prior to the start of the Annual Meeting, including your unique link that will allow you access to the Annual Meeting. You will have the ability to submit questions prior to and during the Annual Meeting. Please be sure to follow instructions found on your proxy card and/or Voting Authorization Form and subsequent instructions that will be delivered to you via email.

Technical assistance will be available one hour prior to and during the Annual Meeting. Information related to technical assistance will be provided in the email with the sign-in instructions. We recommend that you log in at least 15 minutes before the Annual Meeting to ensure you are logged in when the Annual Meeting starts. You may vote during the Annual Meeting by following the instructions available on the meeting access email.

We have elected to provide access to our proxy materials over the Internet. Accordingly, on or about April 23, 2021,26, 2024, we are mailing a Notice of Internet Availability of Proxy Materials to most of our shareholders of record and we are mailing paper copies of the proxy materials to certain other shareholders of record. All shareholders will have the ability to access the proxy materials on the website referred to in the notice or request to receive a printed set of the proxy materials. You can find instructions on how to request a printed copy by mail or electronically on the notice and on the website referred to in the notice, including an option to request paper copies on an ongoing basis. On April 23, 2021,26, 2024, we intend to make this proxy statement available on the Internet and to commence mailing of the Notice of Internet Availability of Proxy Materials to all shareholders entitled to vote at the Annual Meeting. We intend to mail this proxy statement, together with a proxy card, to those shareholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials, within three business days of such request.

Availability of Proxy Materials for the 20212024 Annual Meeting

This proxy statement and our 20202023 Annual Report are available at www.proxydocs.com/ADPT. This website address contains: the Notice of Annual Meeting of Shareholders, the proxy statement and proxy card sample and the 20202023 Annual Report. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

Who Can Vote, Outstanding Shares

Record holders of our common stock as of the close of business on April 14, 2021,10, 2024, the record date for the Annual Meeting (the “Record Date”), are entitled to vote at the Annual Meeting on all matters to be voted upon. As of the Record Date, there were 140,004,251147,368,324 shares of our common stock outstanding. On each matter presented to our shareholders for vote, the holders of common stock are entitled to one vote per share held as of the Record Date.

You may vote by attending the Annual Meeting and voting via the Internet, via our toll-free telephone number at 866-390-5390 or by submitting a proxy. The method of voting by proxy differs (1) depending on

1

whether you are viewing this proxy statement on the Internet or receiving a paper copy and (2) for shares held as a record holder and shares held in “street name.” If you are a shareholder of record on the Record Date, you can participate in the Annual Meeting online at www.proxypush.com/www.proxydocs.com/ADPT and vote your shares during the Annual Meeting.

Record Holder. If you hold your shares of common stock as a record holder and you are viewing this proxy statement on the Internet, you may vote by submitting a proxy over the Internet by following the instructions on the website

6

referred to in the Notice of Internet Availability of Proxy Materials previously mailed to you. If you hold your shares of common stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the preaddressed, postage-paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card.

Hold in Street Name.If you hold your shares of common stock in street name, which means your shares are held of record by a broker, bank or other nominee, you will receive a notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or other nominee will allow you to deliver your voting instructions over the Internet and may also permit you to vote by telephone. In addition, you may request paper copies of the proxy statement and proxy card from your broker by following the instructions on the notice provided by your broker.

General. If you vote through these facilities, you should be aware that you may incur costs such as usage charges from telephone companies or Internet service providers and that these costs must be borne by you. If you vote through these facilities, then you need not return a written proxy card by mail. The cost of soliciting proxies will be borne by us. We may reimburse banks and brokers and other persons representing beneficial owners for their reasonable out-of-pocket costs. We may use the services of our officers, directors and others to solicit proxies, personally or by telephone, facsimile or electronic mail, without additional compensation.

YOUR VOTE IS VERY IMPORTANT.IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting via the Internet. If you are a shareholder of record on the Record Date, you can participate in the Annual Meeting online at www.proxypush.com/www.proxydocs.com/ADPT and vote your shares during the Annual Meeting. If you properly give your proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed.

All shares entitled to vote and represented by properly submitted proxies (including those submitted electronically, telephonically and in writing), and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no direction is indicated on a proxy, your shares will be voted as follows:

FOR each of the threetwo Class II nominees for director named in this proxy statement;

FOR the compensation of our named executive officers, on an advisory basis (“Say-on-Pay”);

EVERY ONE YEAR for the frequency of our Say-on-Pay vote (“Say-on-Frequency”); and

FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm.

The proxy gives each of Chad Robins, Chad CohenKyle Piskel and Stacy Taylor discretionary authority to vote your shares in accordance with their best judgment with respect to all additional matters that might come before the Annual Meeting. If you receive more than one proxy card or Notice of Internet Availability of Proxy Materials, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit a proxy by telephone or the Internet, submit one proxy for each proxy card or Notice of Internet Availability of Proxy Materials you receive.

2

Revocation of Proxy

If you are a shareholder of record, you may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions:

delivering to our Corporate Secretary a signed written notice of revocation, bearing a date later than the date of the proxy, stating that the proxy is revoked;

signing and delivering a new paper proxy relating to the same shares and bearing a later date than the original proxy;

submitting another proxy by telephone or over the Internet (your latest telephone or Internet voting instructions arewill be followed); or

attending the Annual Meeting online and voting via the Internet, although attendance at the Annual Meeting will not, by itself, revoke a proxy.

Written notices of revocation and other communications with respect to the revocation of Company proxies should be addressed to:

Adaptive Biotechnologies Corporation

1551

1165 Eastlake Avenue East Suite 200

Seattle, WA 9810298109

Attention: SVP, General Counsel and Corporate Secretary

If your shares are held in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so. See below regarding how to vote live if your shares are held in street name.

Attendance at the Annual Meeting

We are excited to once again hold a virtual-only meeting. Based on our experience in 2020,prior years, this format provides broad shareholder access to our meeting, allowing all shareholders with Internet connectivity to have a consistent experience regardless of location, ability to travel or similar factors. We have found it also reduces costs forfactors, while saving us and our shareholders time and for us.travel expenses, and, importantly, reducing our environmental impact. We have paid special attention to the meeting platform features, which provide shareholders the opportunity to vote, ask questions and otherwise participate in the meeting in a manner similar to – to—and in some ways superior to –to— traditional in-person shareholder meetings. While thismeetings, and have found it also reduces costs. The format is particularly useful in light of the continuing COVID-19 pandemic and relatedwhen practical limitations on in-person interaction we believe this format has the potential to facilitate more participationlimit shareholder engagement and shareholder engagement.participation.

If you are the record holder of your shares, you may attend the meeting by registering at the following website: www.proxydocs.com/ADPT. To participate in the Annual Meeting, you will need the control number included on the Notice of Internet Availability of Proxy Materials, your proxy card or the instructions that accompanied your proxy materials. We refer to attending the meeting through this website as attendance “via Internet,” and it is considered the same as attendance in person for all corporate purposes.

If your shares are held in “street name,” in the name of a broker, trustee or other nominee, you may change your vote by submitting new voting instructions to your broker, trustee or other nominee, or, if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the meeting and voting via the Internet.

Brokers or other nominees who hold shares of common stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners.

3

However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or for the approval of other matters that are considered “non-routine” matters without specific voting instructions from the beneficial owner. These non-voted shares are referred to as “broker non-votes.” If your broker holds your common stock in “street name,” your broker will vote your shares on “non-routine” proposals only if you provide instructions on how to vote by filling out the voter instruction form sent to you by your broker with this proxy statement.

Only Proposal No. 43 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Proposals No. 1 (election of directors), and No. 2 (Say-on-Pay) and No. 3 (Say-on-Frequency) are not considered routine matters, and without your instruction, your broker cannot vote your shares for those proposals.

The inspector of elections appointed for the Annual Meeting will tabulate votes cast by proxy or live via Internet at the Annual Meeting. The inspector of elections will also determine whether a quorum is present. In order to constitute a quorum for the conduct of business at the Annual Meeting, a majority of the votes entitled to be cast must be represented in person (via Internet) or by proxy at the Annual Meeting. Shares that abstain from voting on any proposal, or that are represented by broker non-votes, will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining whether a quorum is present.

Proposal No. 1: 1: Election of Directors.Directors. A plurality of the votes cast in the election of directors at the Annual Meeting is required for the election of directors. Accordingly, the threetwo Class II director nominees receiving the highest number of

8

votes will be elected. Abstentions, “withhold” votes and broker non-votes will have no effect on the outcome of the election of directors. Shareholders are not permitted to cumulate votes with respect to the election of directors.

Proposal No. 2:2: Say-on-Pay Vote. We will consider the advisory approval of the compensation of our named executive officers to have been obtained if the number of votes cast for the proposal at the Annual Meeting exceeds the number of votes against the proposal. Because abstentions and brokernon-votes are neither votes for or against the proposal, they will have no effect on the outcome of the vote. This vote is advisory and not binding on us, our board of directors or our compensation and human capital committee.

Proposal No. 3: Say-on-Frequency Vote. We will consider the advisory approval of the frequency of Say-on-Pay votes to be the frequency alternative (every one year, two years or three years) that receives a number of votes cast for the alternative that exceeds the number of votes cast for the other alternatives. Because abstentions and brokernon-votes are not votes for any of the alternatives, they will have no effect on the outcome of the vote. If none of the frequency alternatives receives a majority of the votes cast, the frequency that receives the highest number of votes cast will be deemed to be the frequency recommended by the shareholders. This vote is advisory and not binding on us, our board of directors or our compensation committee.

Proposal No. 4: 3:Ratification of Independent Registered Public Accounting Firm.Firm. The number of votes for must exceed the number of votes against in order to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm. Abstentions are considered to be votes not cast on this proposal and thus will have no effect. Brokers generally have discretionary authority to vote on the ratification of our independent registered public accounting firm, thus broker non-votes are not expected to result from the vote on Proposal No. 4.3.

In their discretion, the proxy holders named in the proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The board of directors knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this proxy statement. In addition, no shareholder proposal or nomination was received on a timely basis, so no such matters may be brought to a vote at the Annual Meeting.

Our board of directors is soliciting proxies for the Annual Meeting from our shareholders. We will bear the entire cost of soliciting proxies from our shareholders. In addition to the solicitation of proxies by delivery of the Notice of Internet Availability of Proxy Materials or proxy statement by mail, we will request that brokers, banks and other nominees that hold shares of our common stock, which are beneficially owned by our shareholders, send Notices of Internet Availability of Proxy Materials, proxies and proxy materials to those beneficial owners

4

and secure those beneficial owners’ voting instructions. We will reimburse those record holders for their reasonable expenses. We do not intend to hire a proxy solicitor to assist in the solicitation of proxies. We may use several of our regular employees, who will not be specially compensated, to solicit proxies from our shareholders, either personally or by telephone, Internet, facsimile or special delivery letter.

Communicating with our Board of Directors

Shareholders who wish to communicate with our board of directors or specific individual directors may do so by letter sent to our principal executive offices, addressed to the attention of our Corporate Secretary. Our Corporate Secretary reviews all communications and forwards them to the intended recipient(s) consistent with a screening policy, which provides that sales materials, routine items and items unrelated to the duties and responsibilities of the board of directors are not relayed to directors.

Shareholder Recommendations for Director Nominees

In evaluating potential director nominees, our nominating and corporate governance committee will consider director candidates recommended by our shareholders, provided such recommendations are validly made by the Company’sour shareholders pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) and our Bylaws. Shareholders who wish to recommend a candidate to our nominating and corporate governance committee for consideration for nomination should send to us, at our principal executive offices, information regarding the candidate.

9

A list of shareholders eligible to vote at the Annual Meeting will be available for inspection, for any purpose germane to the Annual Meeting, at our principal executive offices during regular business hours for a period of no less than ten days prior to the Annual Meeting. Information required to gain access to the list of shareholders eligible will also be provided upon request during the same time period.

This proxy statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020,2023, and in our periodic reports on Form 10-Q andas well as our current reports on Form 8-K.

5

2023 COMPANY HIGHLIGHTS

Selected 2023 Corporate Performance Highlights

Summary of Performance

In 2023, we continued to pursue our business around two main areas: clinical assessment of minimal residual disease (“MRD”) in lymphoid malignancies and immune medicine (“IM”)-driven drug discovery and development.

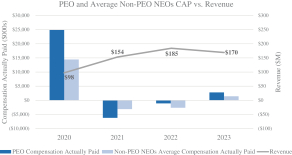

Our boardrevenue in 2023 was $170.3 million compared to $185.3 million in 2022, with the reduction being accounted for in large part by a decline in the amortization of directors consiststhe upfront payment made in 2019 by our cell therapy partner, Genentech, Inc. (“Genentech”), a slowdown in pharma services largely due to broader macroeconomic factors impacting the biopharmaceutical industry and no MRD milestones.

At the same time, our operating expenses were significantly leveraged as a result of eight members. Our directors hold office until their successors have been electedcontinued streamlining of our operations during the year. Operating expenses were $397.3 million during 2023, of which $25.4 million represented non-cash impairment charges, as compared to $385.5 million during 2022. As of December 31, 2023, cash, cash equivalents and qualified or untilmarketable securities was $346.4 million. We estimate positive adjusted EBITDA for the earlier of their resignation or removal. Our Articles of Incorporation and Bylaws provide that our directors may only be removed for cause and then onlyMRD business by the holdersend of 2025, and cash flow breakeven by the shares entitledend of 2026.1

Selected 2023 Results

MRD Highlights

We grew clonoSEQ test volume by 53% year over year. Clinical test revenue increased by 53% over 2022. Payor coverage for the test has grown to elect300 million lives in B cell acute lymphoblastic leukemia and multiple myeloma, 200 million lives in chronic lymphocytic leukemia and 70 million lives in diffuse large B cell lymphoma. United States average selling prices for the director or directors whose removal is sought if,test also increased by 13% quarter-over-quarter in the fourth quarter of 2023.

We integrated the clonoSEQ clinical diagnostic test via the Epic System Corporation’s (“Epic”) comprehensive electronic medical record (“EMR”) system into the records systems of four accounts in 2023 to enable easier test ordering, with a fifth account nearing launch. We will be focused on account-by-account implementation through 2024 and expect to have Epic EMR integrated with 15 to 20 accounts by year end. Additional accounts will be integrated with the Flatiron Health, Inc. EMR system in 2024, as well.

Our MRD Pharma revenue, excluding milestones, increased by 1% from 2022, attributable primarily to the slowdown in pharma services due to broader macroeconomic factors impacting the biopharmaceutical industry. Nevertheless, as of December 31, 2023, our clonoSEQ assay was being used in 143 active trials being conducted by 43 biopharmaceutical partners, including 75 trials in which it represents a clinical endpoint (primary endpoint in 10 trials).

IM Highlights

In IM drug discovery, we made significant advances in connection with our worldwide collaboration and license agreement with Genentech with respect to both the shared and personalized products. For the shared product, we completed an assessment of efficacy and safety data which enabled selection of a particular director,T cell receptor (“TCR”) candidate to progress as a potential therapeutic product candidate for which investigational new drug clearance was obtained in 2023. In addition, fully characterized TCR data packages against validated neoantigen targets have also been provided to Genentech for consideration.

| 1 | Adjusted EBITDA is a non-GAAP financial measure that we define as net loss attributable to Adaptive Biotechnologies Corporation adjusted for interest and other income, net, interest expense, income tax (expense) benefit, depreciation and amortization expense, impairment costs for right-of-use and related long-lived assets, restructuring expense and share-based compensation expense. |

6

For the numberpersonalized product, blood samples from 165 cancer patients have been screened. Proof of votes castconcept for a personalized product has been completed by identifying and characterizing patient specific TCRs to unique tumor mutations. In 2023, we successfully built our personalized process workflow in favor of removing such director (orour South San Francisco lab under regulated conditions, which will enable us to complete end-to-end testing. This defines the entire board of directors) exceeds the number of votes cast against removal, and that any vacancy on our board of directors, including a vacancy resulting from an enlargementfoundation for future clinical readiness of our board of directors, may be filled only by the affirmative vote offully personalized process.

Focusing on autoimmune disease, we continued our drug discovery efforts in conditions such as multiple sclerosis (“MS”), Crohn’s disease, type 1 diabetes and rheumatoid arthritis, and discovered a majority of our directors thennovel therapeutic target in office.

Our board of directors has determined that all members of our board of directors, except Chad Robins, are independent directors for purposesMS. Validation of the rulesdiscovered self-antigen as a therapeutic target in MS and assessment of Nasdaqtherapeutic modalities against it is planned to occur over the next few years.

Selected Environmental and the Securities and Exchange Commission (“SEC”). In making this determination, our board of directors considered the relationships that each non-employee director has with us and all other facts and circumstances that our board of directors deemed relevant, including the beneficial ownership of our common stock by each non-employee director. The composition and functioning of our board of directors and each of our committees complies with all applicable requirements of Nasdaq and the rules and regulations of the SEC.Social Responsibility Highlights

Chad Robins, our Chief Executive Officer and Chairman of our board of directors, is the brother of Dr. Harlan Robins, our Chief Scientific Officer. There are no other family relationships among any of our directors or executive officers.

In accordance with the terms of our Articles of Incorporation and Bylaws, our board of directors is divided into three staggered classes of directors and each director is assigned to one of the three classes. At each annual meeting of the shareholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The terms of the directors will expire upon the election and qualification of successor directors at the annual meeting of shareholders to be held during the years 2021 for Class II directors, 2022 for Class III directors and 2023 for Class I directors.

Our Class I directors are Katey Einterz Owen, PhD, and Robert Hershberg, PhD, MD;

Our Class II directors are Michelle Griffin, Peter Neupert and Leslie Trigg; and

Our Class III directors are Kevin Conroy, Michael Pellini, MD and Chad Robins.

Our Articles of Incorporation and Bylaws provide that the number of directors shall be fixed from time to time by a resolution of the majority of our board of directors.

10

The division of our board of directors into three classes with staggered three-year terms may delay or prevent shareholder efforts to effect a change of our management or a change in control.

Diversity, Equity and Inclusion

We pride ourselves on inclusive team building, product design and gender diversity at all levels of management, including the board of directors. We are committed to creating and maintaining a culture of belonging. In 2020, we expanded and implemented several diversity and inclusion initiatives. We launched multiple employee resource groups, including Women@Adaptive, Adaptive PRIDE, Black Adapter Network and Working Life and Wellness. We developed diversity sourcing programs and implemented hiring manager diversity training. We also established an Equity Advisory Council of senior leaders focused on specific objectives looking at clinical studies, commercial engagement, recruiting and retention through a diversity and inclusion lens. We also integrated hidden bias training into our Leader of People Program. Most recently, we launched a STEM minority mentoring program with a local university. Further, the recent addition of Ms. Trigg and Dr. Owen to the board of directors affirms our commitment to gender diversity at a board level.

Employee Development and Training

We prioritize employee development and training and have established programs to support a culture of employee development. Specifically, in 2020, we offered multiple learning solutions, including our Leader Orientation Program, our Leader of People Program, and our L-re:combinator Program. Our Leader Orientation Program is an eight-week blended learning program that features self-paced online learning and live virtual training, designed to train new line to mid-level leaders about our culture, HR policies, communication, motivation and more. Our Leader of People Program is a three-part, 15-week program designed to train leaders on change management, interviewing and hiring the best talent, having difficult discussions and creating alignment. Our L-re:combinator Program is a peer-to-peer learning group that provides mid-level managers with education, support and collaboration opportunities. In 2020, over 100 Adapters attended leadership development programs and consumed over 2,000 hours of training.

We are committed to operating in an environmentally responsible and efficient manner to minimize adverse impacts on the environment. Asenvironment and have submitted materials relating to our environmental, sustainability and social programs to third party Ecovadis for scoring.

For example, as part of our AdaptiGREEN initiative, we have implemented a variety of composting and recycling programs, including recycling of cardboard, Styrofoam, batteries, Keurig Coffee Pods and sustainable disposition of biohazard waste. Our biohazard waste is destroyed by incineration and the energy generated is captured and used to heat homes on the west coast. Our laboratories reduce energy consumption by utilizing a “night set back” function, which reduces the number of air changes per hour and the flow of ventilation in our fume hoods at night.

With respect to Adaptiveour commuter programs, Adaptive followswe follow the King County Commuter Trip Reduction program; we actively support commuting via bikebicycle and we provide all the amenities required – secure bike storage, onsite self-serve maintenance tools and equipment, and full-service shower rooms. Our all-in-one commuter platform, Luum, enables employees to log their daily commute and obtain “Green Credits” when they commute to work by either bicycle or walking. This credit is in the form of a daily stipend that is paid to eligible employees twice a month and can be used for things like bicycle parts and walking shoes. The Luum platform tracks CO2 avoidance for each employee based on the form of commute transportation they choose each day. We also offer free transit cards (ORCA sound transit) to eligible employees that can be used across multiple public transportation systems. Charging stations for electric carcars and bike charging stationsbikes are also provided in the buildings utilized by Adaptive staff.employees. In addition, a substantial number of our employees work from home either part-or full-time, which presents the opportunity for a reduced carbon footprint. In connection

We also work with our expansion into a new corporate headquarters at 1165 Eastlake Avenue East, we are collaborating with our landlordlandlords to establishsupport sustainability programs such as those associated with the Green Chemistry Institute, laboratory equipment and electronics recycling. At our headquarters, we operate an urban beekeeping program in association with Alveolé, with rooftop hives to help bolster our commitment to local sustainability. The rooftop of our headquarters also includes gardens maintained by employees in conjunction with our Environmental & Sustainability ERG from which vegetables are sourced for local food insecurity programs.

We also expect our suppliers to operate in an environmentally responsible and efficient manner. Our supplier codeSupplier Code of conductConduct requires suppliers to comply with all applicable environmental regulations; to have systems in place to ensure safe handling, movement, storage, recycling, reuse or management of waste, air emissions and wastewater discharges; and to have systems in place to prevent and mitigate accidental spills and releases of fuels, raw materials, chemicals, intermediates, products and other hazardous materials to the environment.

Our People

Our employees, internally referred to the COVID-19 pandemic, we extendedas “Adapters,” are passionate about immune medicine, empowered by scientific discipline and fueled by our collaboration with Microsoftforesight and initiated the ImmuneCODE Program to collect, analyze and publicize datacuriosity about the T cell receptors specific to SARS-CoV-2. We opened our own prospective 1,000 patient study called ImmuneRACE to collect blood samples from people who have been exposed, are actively fighting or have recently recovered from COVID-19 and we are also collecting approximately 4,000 samples from participating institutions around the world that are interested in contributing to this massive effort. Our goal is to leverage the existing capabilities of our high throughput platform to generate an unprecedented amount of T cell data from these patients to understand the adaptive immune responsesystem. As of December 31, 2023, we had 709 full-time employees of which 132 hold medical or doctoral degrees. None of our employees are subject to COVID-19. Importantly,a collective bargaining agreement and we have not experienced any work stoppages. We believe relations with our employees are making these data freely availablegood. For example, we were named the Work Place of the Year by GeekWire in 2023.

Diversity and Inclusion

We pride ourselves on inclusive team building, product design and gender diversity at all levels of management. We are committed to researchers, publiccreating and maintaining a culture of belonging.

Compensation and Benefits

We strive to provide compensation and benefits that are competitive to market and create incentives to attract and retain employees. Our compensation package includes market-competitive base pay, performance-based short-term incentives, health officialscare, retirement benefits, paid time off and organizations aroundfamily leave. In addition, we offer employees the world via an open databenefit of equity ownership in the Company through restricted stock unit awards. We also provide access portalto a variety of health and wellness resources.

Employee Development and Training

We prioritize employee development and training and have established programs to support a culture of employee development. Our Adaptive Leadership Council provides senior employees with the goalaccess to, advance solutions to the pandemic.and a voice in, management decisions.

We are committed to ensuring that our products are manufactured and supplied at high standards of quality. Our manufacturing operations are conducted in compliance with applicable regulatory requirements, Good Clinical Laboratory Practices and our own internal rigorous quality standards. We also require that our suppliers and partners adhere to high standards, and we conduct audits and oversight of our supply chain.

In addition, it is our policy to comply with all applicable drug, medical device, diagnostic, clinical laboratory and research laws and regulations, including Food and Drug Administration (“FDA”) registration, notification, and/or approval, marketing and sales, research and manufacturing requirements, such as Good Laboratory Practices, Good Manufacturing Practices and Good Clinical Practices, as applicable. We also comply with Clinical Laboratory Improvement Amendments of 1988 requirements and related regulations for clinical laboratory testing, where applicable.

8

CORPORATE GOVERNANCE

Our Board

Our continuing directors and their respective ages (as of April 10, 2024) and class designations are as follows:

Name | Age | Director Designation | ||

Michelle Griffin | 58 | Class II Director | ||

Robert Hershberg, PhD, MD | 61 | Class I Director | ||

Peter Neupert | 68 | Class II Director | ||

Katey Owen, PhD | 55 | Class I Director | ||

Michael Pellini, MD | 58 | Class III Director | ||

Chad Robins | 49 | Class III Director |

Our Criteria for Board Nomination and Service

Our criteria for board membership include specific measures for determining whether a director will be able to devote sufficient time and effort to the role, including consideration of the potential impact of service on other public company boards. This determination is made at the time of nomination and as appropriate during a director’s service on our board if their circumstances change, recognizing that the ability to fully engage in multiple activities will vary depending on the director and the activities.

In that respect, our criteria relating to devotion of time and effort to the Company board include:

| • | Time and Effort: Willing to commit the time and energy necessary to satisfy the requirements of the board and board committee membership; attendance and participation in all board meetings and board committee meetings in which they are a member; willingness to rigorously prepare prior to each meeting and actively participate in the meeting as a thought partner; willingness to make himself/ herself available to management upon request to provide advice and counsel. |

In addition, our Bylaws currently address the question of what levels of service on other companies’ boards will be considered permissible for our board directors as follows:

Serving on the board of directors has adoptedrequires significant time and attention. Directors are expected to spend the time needed and meet as often as necessary to discharge their responsibilities properly. It is expected that, without specific approval from the board of directors: (i) no director shall serve on more than five public company boards (including our board) or on the board of any company that, in our board’s judgment, materially competes with the Company, (ii) if any officer of the Company is also a director of the Company, such officer may not serve on more than two public company boards (including our board), and (iii) no member of the Audit Committee shall serve on more than three public company audit committees (including the Company’s Audit Committee). Directors should advise the chairperson of the Nominating and Governance Committee before accepting membership on other boards of directors or other significant commitments involving affiliation with other businesses, non-profit entities or governmental units.

In addition, the nominating and corporate governance guidelines covering, amongcommittee considers individual qualifications, including relevant career experience, strength of character, maturity of judgment and familiarity with our business and industry, as well as all other things,factors it considers appropriate for all board nominations, whether made by shareholders or others.

9

The following skills and experiences were considered by the dutiesnominating and responsibilities of and independence standards applicable to our directors and board committee structures and responsibilities. These guidelines are available on the “Corporate Governance” section of our website at https://investors.adaptivebiotech.com/governance/governance-documents. Our corporate governance guidelines providecommittee in nominating our non-employee directors:

Current Board Member | Core-competency / Experience | Representative Relevant Skill Sets | ||

| Michelle Griffin | Compliance and risk management; Therapeutics / Drug Discovery: commercialization expertise | Director of life sciences companies; past audit committee chair experience; past CEO/CFO experience; overall extensive operational experience in the biotechnology industry and deep experience in public company financial matters; MBA | ||

| Robert Hershberg | Therapeutics / Drug Discovery: extensive R&D and commercialization expertise | CEO positions in the biotechnology industry; deep technical expertise; overall extensive executive leadership experience in the biotechnology industry, including operational experience managing sustained revenue and commercial growth in a strategic manner; PhD/MD | ||

| Peter Neupert | Diagnostic and Pharmaceutical Services: commercial expertise; Capital growth; Finance (funding) | Director of diagnostic laboratory services provider; venture capital provider experience; overall extensive experience in executive leadership roles in the health services sector and as a member of the board of directors of several organizations in the biotechnology industry; MBA | ||

| Katey Owen | Therapeutics / Drug Discovery: R&D expertise | Director level position in pharmaceutical development; overall extensive scientific expertise and strategic insights into commercialization and manufacturing at scale; PhD | ||

| Michael Pellini | Diagnostic and Pharmaceutical Services: commercial expertise; Capital growth; Finance (funding) | Venture capital provider experience; past biotechnology CEO experience; overall extensive medical and clinical experience in the biotechnology industry, including operational experience managing sustained revenue and commercial growth in a strategic manner; MD/MBA | ||

All board members have global expansion and distribution experience, as well as high level strategic corporate development knowledge.

10

While we do not have a formal policy on diversity for members of the board of directors, with flexibility to combinethe nominating and corporate governance committee values and, as reasonable, acts on the need for diversity of director demographics, skills and viewpoints when considering new candidates. The diversity characteristics of our directors are below. None identify as LGBTQ+ or separate the positions of chairpersonas an underrepresented minority; however, future candidates which do so identify and meet our criteria for board service will be considered, as appropriate.

Board Diversity Matrix (As of April 10, 2024) | ||||||||

Total Number of Directors – 6 |

| |||||||

| Female | Male | |||||||

Part I: Gender Identity | ||||||||

Directors | 2 | 4 | ||||||

Part II: Demographic Background |

| |||||||

White | 2 | 4 | ||||||

Family Relationships

Chad Robins, our Chief Executive Officer and Chairman of our board of directors, and Chief Executive Officer and to appoint a lead independent director in accordance with its determination that using one or the other structure would be in our best interests. Chad Robins is the current chairmanbrother of Dr. Harlan Robins, our Chief Scientific Officer. There are no other family relationships among any of our board of directors and Peter Neupert currently serves as the lead independent director of our board of directors.or executive officers.

Board Leadership Structure

Our board of directors has concluded that our current board leadership structure is appropriate for Adaptive’s needs at this time. Our board of directors continues to believe that the combined role of chairperson and Chief Executive Officerchief executive officer promotes united leadership and direction and provides management a clear focus to execute our strategy and business plans. As Chief Executive Officer, Mr. Robins is best suited to ensure that critical business issues are brought before our board of directors, which enhances our board of directors’ ability to develop and implement business strategies.

In his role as lead independent director, Mr. Neupert presides over the independent director sessions of our board of directors in which Mr. Robins, as our Chief Executive Officer, does not participate and serves as a liaison to management on behalf of the non-employee members of our board of directors. Mr. Neupert has been on our board of directors since December 2013, is an independent director who serves on our compensation and human capital committee, audit committee and our nominating and corporate governance committee, has been an executive officer of public companies, and has meaningful experience as an independent director for other public companies. Accordingly, we believe Mr. Neupert provides a strong voice for our independent directors.

All directors are encouraged to suggest the inclusion of agenda items and meeting materials, and any director is free to raise at any board meeting items that are not on the agenda for that meeting.

Our non-employee directors regularly meet in executive sessions without the presence of any members of management. The lead independent director presides at these meetings and provides the guidance and feedback of our non-employee directors to our Chairman and management team.

Our board of directors, as a whole, has responsibility for risk oversight, and each committee of our board of directors oversees and reviews risk in areas that are relevant to it, including: (1) for the compensation and human capital committee, risks associated with the Company’sour compensation arrangements and policies;policies (including, as relevant, matters pertaining to our environmental and social policies and practices); (2) for the nominating and corporate governance committee, periodic review and update of our code of conduct and ethics;ethics as well as corporate governance-specific policies; and (3) for the audit committee, internal controls and regulatory risks related to accounting and finance.finance, as well as periodic review of cybersecurity and privacy risks. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board of directors and to our personnel who are responsible for risk assessment information about the identification, assessment and management of critical risks.

11

Size of Board

Our board of directors consists of six members. Our directors hold office until their successors have been elected and qualified or until the earlier of their resignation or removal. Our Articles of Incorporation and Bylaws provide that our directors may only be removed for cause and then only by the holders of the shares entitled to elect the director or directors whose removal is sought if, with respect to a particular director, the number of votes cast in favor of removing such director (or the entire board of directors) exceeds the number of votes cast against removal, and that any vacancy on our board of directors, including a vacancy resulting from an enlargement of our board of directors, may be filled only by the affirmative vote of a majority of our directors then in office.

Staggered Board and Shareholder Proposals

In accordance with the terms of our Articles of Incorporation and Bylaws, our board of directors is divided into three staggered classes of directors and each director is assigned to one of the three classes. We continue to believe that this board structure is the best choice for Adaptive at this time.

At each annual meeting of the shareholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The terms of the directors will expire upon the election and qualification of successor directors at the annual meeting of shareholders to be held during the years 2024 for Class II directors, 2025 for Class III directors and 2026 for Class I directors.

Our Articles of Incorporation and Bylaws provide that the number of directors shall be fixed from time to time by a resolution of the majority of our board of directors.

Shareholder proposals may be tendered in the first quarter; however, the division of our board of directors into three classes with staggered three-year terms may delay or prevent shareholder efforts to effect an immediate change of our management or a change in control.

While we have no formal policy with respect to shareholder nominees, the committee will consider recommendations validly made by our shareholders pursuant to Rule 14a-8 under the Exchange Act and our Bylaws.

Board Governance Guidelines

Our board of directors has adopted corporate governance guidelines covering, among other things, the duties and responsibilities of and independence standards applicable to our directors and board committee structures and responsibilities. These guidelines are available on the “Governance” section of our website at https://investors.adaptivebiotech.com/governance/governance-documents.

Our corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of chairperson of our board of directors and chief executive officer and to appoint a lead independent director in accordance with its determination that using one or the other structure would be in our best interests. Chad Robins is the current chairman of our board of directors and Peter Neupert currently serves as the lead independent director of our board of directors.

Attendance by Members of the Board at Meetings

Our board of directors held sixeight meetings and acted by unanimous written consent sevenfour times during the year ended December 31, 2020.2023. During 2020,2023, all then incumbent directors attended at least 75%all but one of the combined total of (1) all board meetings and (2) all meetings of committees of our board of which the incumbent director was a member. Currently, we do not maintain a formal policy regarding director attendance at the Annual Meeting; however, it is expected that, absent compelling circumstances, each of our directors will attend our Annual Meeting via the Internet. All directors attended the virtual annual meeting in 2020.2023.

12

Our non-employee directors meet regularly in executive sessions without management to consider such matters as they deem appropriate. Our lead independent director, Mr. Neupert, presides over all executive sessions.

Committees of our Board of Directors

Our board of directors has established an audit committee, a compensation and human capital committee and a nominating and corporate governance committee, each of which operates pursuant to a written charter adopted by our board of directors. Our board of directors may also establish other committees from time to time to assist the board of directors. The composition and functioning of all of our committees comply with all applicable requirements of the Sarbanes-Oxley Act, Nasdaq and SECSecurities and Exchange Commission (“SEC”) rules and regulations, subject to applicable phase-in periods for committees. Each committee has a charter, which is available on our website at www.adaptivebiotech.com.

Independence and Current Committee Positions

Our board of directors has determined that all members of our board of directors, except Chad Robins, are independent directors for purposes of the rules of Nasdaq and the SEC. In making this determination, our board of directors considered the relationships that each non-employee director has with us and all other facts and circumstances that our board of directors deemed relevant, including the beneficial ownership of our common stock by each non-employee director. The composition and functioning of our board of directors and each of our committees complies with all applicable requirements of Nasdaq and the rules and regulations of the SEC.

The composition of our board committees and independence of their members are summarized below:

Name |

| Independent | Audit Committee | Compensation and Human Capital Committee | Nominating and Governance Committee | |||

|

|

| ||||||

|

| |||||||

Michelle Griffin |

| Yes | Member (Chair) |

|

| |||

Robert Hershberg, PhD, MD | Yes |

| Member (Chair) |

| ||||

Peter Neupert(1) | Yes | Member | Member | Member (Chair) | ||||

Katey Owen, PhD | Yes |

|

| Member | ||||

|

|

|

|

| ||||

Michael Pellini, MD |

| Yes | Member |

| Member | |||

Chad Robins | No |

|

|

|

(1) | Lead Independent Director |

Audit Committee Service and Responsibilities

During 2020,the first half of 2023, Michelle Griffin, Eric Dobmeier and Michael Pellini, MD and former director Leslie Trigg served on the audit committee, which is currently chaired by Ms. Griffin. David Goel also servedPeter Neupert replaced Ms. Trigg on the audit committee untilafter her resignation from our board in June 2020, and in March 2021, Ms. Trigg replaced Mr. Dobmeier on the audit committee.2023. The audit committee met sevenfive times during fiscal year 2020.2023. Our board of directors has determined that each member of the audit committee during 2023 was and is “independent” as that term is defined in Nasdaq rules and has sufficient knowledge in financial and auditing matters to serve on the audit committee. In addition, our board of directors has determined that Ms. Griffin, Dr. Pellini, and Mr. Neupert each meet (and, during her service, Ms. Trigg and Dr. Pellini each meetmet) the heightened independence requirements for audit committee members required under Section 10A of the Exchange Act and related SEC and Nasdaq rules. Mr. Dobmeier met these requirements prior to his resignation in March 2021. For 2020, Mr. Goel did not meet these heightened independence requirements because he may have been deemed to have investment and voting power over the shares of our common stock held by Matrix Fund in his capacity as the sole Managing General Partner of Matrix Capital Management, LP, and we relied, until June 2020, on the phase-in schedules set forth in Rule 10A-3(b)(1)(iv)(A) under the Exchange Act with respect to Mr. Goel’s service on the audit committee, which ended prior to the first anniversary of our initial public offering. We do not believe such reliance materially adversely affected the ability of the audit committee to act independently and to satisfy the other applicable legal requirements during Mr. Goel’s service.

Our board of directors has determined that each member of the audit committee is an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K. The audit committee’s responsibilities include:

appointing,Appointing, approving the compensation of and assessing the independence of our independent registered public accounting firm;firm.

13

13

pre-approvingPre-approving audit and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm;firm.

reviewingReviewing the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements;statements.

reviewingReviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures, as well as critical accounting policies and practices used by us;us.

coordinatingCoordinating the oversight and reviewing the adequacy of our internal control over financial reporting;reporting.

establishingEstablishing policies and procedures for the receipt and retention of accounting-related complaints and concerns;concerns.

recommending,Recommending, based upon the audit committee’s review and discussions with management and our independent registered public accounting firm, whether our audited financial statements should be included in our Annual Report on Form 10-K;10-K.

monitoringMonitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters;matters.

preparingPreparing the audit committee report required by SEC rules to be included in our annual proxy statement;statement.

reviewingReviewing related person transactions for potential conflict of interest situations and approving all such transactions;transactions in accordance with our policies.

Reviewing content and

reviewing talking points of our quarterly earnings releases.releases in parallel with the full board of directors.

In addition, the audit committee periodically reviews our insider trading policy, which prohibits short sales, pledging, hedging or other monetization transactions, and other transactions which would, if consummated, allow insiders to continue to own our securities without the full risks and rewards of ownership.

Compensation and Human Capital Committee Service and Responsibilities

Until September 2023, Robert Hershberg, PhD, MD, Peter Neupert and former director Kevin Conroy serve on the compensation committee, which has been chaired by Dr. Hershberg since June 2020. Dr. Andris Zoltners served on the compensation and human capital committee, until June 2020.chaired by Dr. Hershberg. Katey Owen replaced Mr. Conroy on the committee after his resignation from our board in September 2023. The compensation committee met fivefour times during fiscal year 2020, and each member attended all meetings.2023. Our board of directors has determined that each member of the compensation and human capital committee during 2023 was and is “independent” as that term is defined in Nasdaq rules and is a “non-employee“non-employee director” under Rule 16b-3 under the Exchange Act. In addition, our board of directors has determined that Dr. Hershberg, Mr. Neupert and Ms. Owen each meet (and, during his service, Mr. Conroy each meetmet) the heightened independence requirements for compensation and human capital committee purposes under Section 10C of the Exchange Act and related SEC and Nasdaq rules. The compensation and human capital committee’s responsibilities include:

reviewingReviewing and approving our philosophy, strategies, policies and plans with respect to the compensation of our Chief Executive Officer and our other executive officers;officers.

makingMaking recommendations to our board of directors with respect to the compensation of our Chief Executive Officer and our other executive officers;officers.

reviewingReviewing and assessing the independence of compensation advisors;advisors.

overseeingOverseeing and administering our equity incentive plans;plans.

14

reviewingReviewing and making recommendations to our board of directors with respect to director compensation; andcompensation.

preparing the compensation committee reports required by the SEC, including our “Compensation Discussion and Analysis” disclosure.

| • | Preparing the compensation and human capital committee reports required by the SEC, including our “Compensation Discussion and Analysis” disclosure. |

The compensation committee, during its first meeting of the year, addresses achievements of the prior year’s corporate goals for purposes of determining annual cash incentive awards. Following that, most of the significant adjustments to compensation are made to base salary, annual cash incentive and equity awards at the compensation committee’s second meeting of the year, typically held during the first quarter. Specific issues considered with respect to compensation for fiscal year 2020 included salary, annual cash incentives and equity compensation in light of our second year as a public company and the impact of the COVID-19 pandemic, as well as executive officer compensation in light of

14

the products and services developed in response to the pandemic, such as immunoSEQ T-MAP COVID and T-Detect COVID; equity compensation programming, including the development of guidelines to be used for future equity grant cycles, the proper mix of equity vehicles, providing overall pool budgeting and modeling and providing updates with regards to long-term incentive trends among peers; and the non-executive equity compensation program.

The compensation committee also considers at various meetings throughout the year matters related to individual current and future officer compensation, such as compensation for prospective new hires for both our established and emerging lines of business, as well as high-level issues related to compensation strategy, such as efficacy of the current strategy, potential modifications to the strategy, risks created by the strategy, new regulatory requirements and/or the adoption of new trends, and recruitment and retention concerns.

Nominating and Corporate Governance Committee Service and Responsibilities

Kevin Conroy, Michael Pellini, MD, and Peter Neupert serve on the nominating and corporate governance committee, which has been chaired by Mr. Neupert since June 2020.Neupert. Mr. Conroy also served on the committee until his departure from our board in September 2023. The nominating and corporate governance committee met twiceonce during 2020.2023. Our board of directors has determined that each of Mr. Conroy, Dr. Pellini and Mr. Neupert is (and, during his service, Mr. Conroy was) “independent” as defined in Nasdaq rules. Mr. Chad Robins, who served as chair of the nominating and corporate governance committee until June 2020, is not “independent” because he is our Chief Executive Officer and we relied on the phase-in schedules set forth in Nasdaq listing rule 5615(b)(1) with respect to Mr. Robins’ historical service on the nominating and corporate governance committee. The nominating and corporate governance committee’s responsibilities include:

| • | Developing and recommending to the board of directors criteria for board and committee membership, including the formal set of board nomination and service qualifications adopted in 2023 and shared under “Our Criteria for Board Nomination and Service” above. |

developing and recommending to the board of directors criteria for board and committee membership, which criteria is set forth in Appendix A of this proxy statement;

establishingEstablishing procedures for identifying and evaluating board of director candidates, including nominees recommended by shareholders;shareholders.

reviewingReviewing the composition of the board of directors to ensure that it is composed of members containing the appropriate skills and expertise to advise us;us.

identifyingIdentifying and screening individuals qualified to become members of the board of directors;directors.

recommendingRecommending to the board of directors the persons to be nominated for election as directors and to each of the board’s committees;committees.

developingDeveloping and recommending to the board of directors a code of business conduct and ethics and a set of corporate governance guidelines; andguidelines.

overseeingOverseeing the evaluation of our board of directors and management.

The nominating and corporate governance committee will consider director candidates recommended by shareholders on the same basis that it evaluates other nominees for director. Shareholders who wish to recommend a candidate to our nominating and corporate governance committee for consideration for nomination should send to us, at our principal executive offices, information regarding the candidate. In order to identify potential director candidates, the committee may utilize its or our existing networks or retrainretain a third-party recruiting firm.

At a minimum, the nominatingCompensation and corporate governance committee considers individual qualifications, including relevant career experience, strength of character, maturity of judgment and familiarity with our business and industry, in addition to the factors set forth in Appendix A of this proxy statement, as well as all other factors it considers appropriate. With respect to nominations made directly by shareholders, the committee will consider the factors enumerated above. While we have no formal policy with respect to shareholder nominees, the committee will consider recommendations validly made by our shareholders pursuant to Rule 14a-8 under the Exchange Act and our Bylaws.

While we do not have a formal policy on diversity for members of the board of directors, the nominating and corporate governance committee values the need for diversity of director skills and viewpoints when considering new candidates, as evidenced by the recent recruitment and appointment of Ms. Trigg and Dr. Owen.

15

CompensationHuman Capital Committee InterlocksInterlocks and Insider Participation

During 2020,At times as noted above, Kevin Conroy, Robert Hershberg, PhD, MD, Peter Neupert, and Andris Zoltners, PhDKatey Owen served as members of our compensation committee. Noneand human capital committee during 2023. During 2023, none of the members of our compensation and human capital committee has during the prior fiscal year been one of ourwere officers or employees or except for Dr. Zoltners, had a relationship requiring disclosure under “Relationships“Relationships and Related Party Transactions.Transactions.” None of our executive officers currently serves, nor in the past fiscal year has served, as a member of the board of directors or compensation and human capital committee of any entity that has one or more executive officers serving on our board of directors or compensation and human capital committee.

With respect to Dr. Zoltners, we were historically party to a management services agreement with ZS Associates (“ZS Agreement”), pursuant to which ZS Associates provided us with certain sales and marketing services pursuant to agreed-upon work orders. We amended and restated the ZS Agreement in 2020. Dr. Zoltners was one of our directors and a founding director of ZS Associates. For the fiscal year ended December 31, 2020, we paid ZS Associates $127,000 for services provided under the ZS Agreement. See “Relationships and Related Party Transactions.” Dr. Zoltners resigned from our board of directors in October 2020.

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. AThe code is updated periodically; a current copy of the code is posted on our website at www.adaptivebiotech.com. IfWhile we make ministerial and technical amendments to the code of conduct and ethics from time to time, if we make any substantive amendments to, or grant any waivers from, the code for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

15

DIRECTOR COMPENSATION

The following table presents the total compensation for each person who served as a non-employee member of our board of directors at any time during the year ended December 31, 2020.2023. Other than as set forth in the table and described more fully below, we did not pay any compensation, make any additional equity awards or non-equity awards to or pay any other compensation to any of the non-employee members of our board of directors in 2020.2023. We reimburse non-employee members of our board of directors for reasonable travel and out-of-pocket expenses incurred in attending meetings of our board of directors and committees of our board of directors.

We also do not, and do not expect to, provide separate compensation to our directors who are also our employees, such as Chad Robins, our Chief Executive Officer. Mr. Robins’ compensation as our principal executive officer in 20202023 is reported in the “Executive Compensation” section of this proxy statement.

Name |

| Fees earned or paid in cash ($) |

|

| Option awards(1) ($) |

|

| Total ($) |

| |||

Kevin Conroy(2) |

|

| 40,000 |

|

|

| 169,989 |

|

|

| 209,989 |

|

Eric Dobmeier(3) |

|

| 40,000 |

|

|

| 169,989 |

|

|

| 209,989 |

|

David Goel(4) |

|

| 40,000 |

|

|

| 169,989 |

|

|

| 209,989 |

|

Michelle Griffin(5) |

|

| 60,000 |

|

|

| 169,989 |

|

|

| 229,989 |

|

Robert Hershberg, PhD, MD(6) |

|

| 47,500 |

|

|

| 169,989 |

|

|

| 217,489 |

|

Peter Neupert(7) |

|

| 87,500 |

|

|

| 169,989 |

|

|

| 257,489 |

|

Michael Pellini, MD(8) |

|

| 40,000 |

|

|

| 169,989 |

|

|

| 209,989 |

|

Andris Zoltners, PhD(9) |

|

| 31,522 |

|

|

| 169,989 |

|

|

| 201,511 |

|

Name | Fees Earned or Paid in Cash ($) | Option Awards(1) ($) | Stock Awards(2) ($) | Total ($) | ||||||||||||

Kevin Conroy(3) | 40,272 | 124,999 | 124,997 | 290,268 | ||||||||||||

Michelle Griffin(4) | 80,000 | 124,999 | 124,997 | 329,996 | ||||||||||||

Robert Hershberg, PhD, MD(5) | 75,000 | 124,999 | 124,997 | 324,996 | ||||||||||||

Peter Neupert(6) | 105,000 | 124,999 | 124,997 | 354,996 | ||||||||||||

Katey Owen, PhD(7) | 60,000 | 124,999 | 124,997 | 309,996 | ||||||||||||

Michael Pellini, MD(8) | 60,000 | 124,999 | 124,997 | 309,996 | ||||||||||||

Leslie Trigg(9) | 26,301 | 124,999 | 124,997 | 276,297 | ||||||||||||

(1) | In accordance with SEC rules, amounts in this column reflect the aggregate grant date fair value of stock options granted during |

| (2) | In accordance with SEC rules, amounts in this column reflect the aggregate grant date fair value of restricted stock units (“RSUs”) granted during 2023 computed in accordance with ASC |

| (3) |

|

| (4) | As of December 31, |

| As of December 31, |

| As of December 31, |

16

| As of December 31, |

| As of December 31, |

| Ms. Trigg resigned from our board of directors on June 9, 2023. As of December 31, |

|

|

|

|

16

Our board of directors has adopted a non-employee director compensation policy amended on February 14, 2021, that is designed to enable us to attract and retain, on a long-term basis, highly qualified non-employee directors. Specifically, we provide $50,000provided $60,000 annual cash retainer payments payable quarterly in arrears, to each director who is not an employee of ours, with additional amounts for those serving as Lead Independent Director and chairpersons of our audit, compensation, and nominating and corporate governance committees, as set forth below:

Additional

| ||||

Lead Independent Director | 35,000 | |||

Audit Committee Chairperson | 20,000 | |||

Compensation and Human Capital Committee Chairperson | 15,000 | |||

Nominating and Corporate Governance Committee Chairperson | 10,000 | |||